How to Pay off Business Debt Quickly | 6 Tips for Managing Debt

Hello readers! Today we are going to discuss an important topic how to Pay off Business Debt Quickly with 6 important tips for managing debt. Debt is something which can help a business grow and also can be the reason of business failure. The main reason behind debt resulting in failure is the mismanagement of debt. So today we at financehelps.in are going to explain to you everything about business debt and how one can control the business debt.

First, let us have a clear idea of what is business debt?

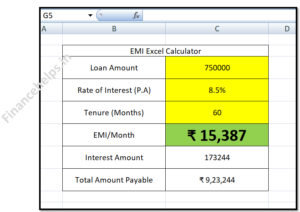

Debt by the term means owing money to another party at some rate of interest. Businesses take debt to carry out their business for a certain period. Now business also takes debt in various ways in the form of loan from bank against some rate of interest, borrowing from family or friends on certain terms, Credit from suppliers etc.

Now to manage your business debts one needs to have a proper debt management plan about which you can read our post on Debt Management Plan and How to Eliminate Debt Fast. There you can download the free template. This post is about concept on personal debt management.

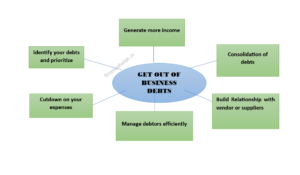

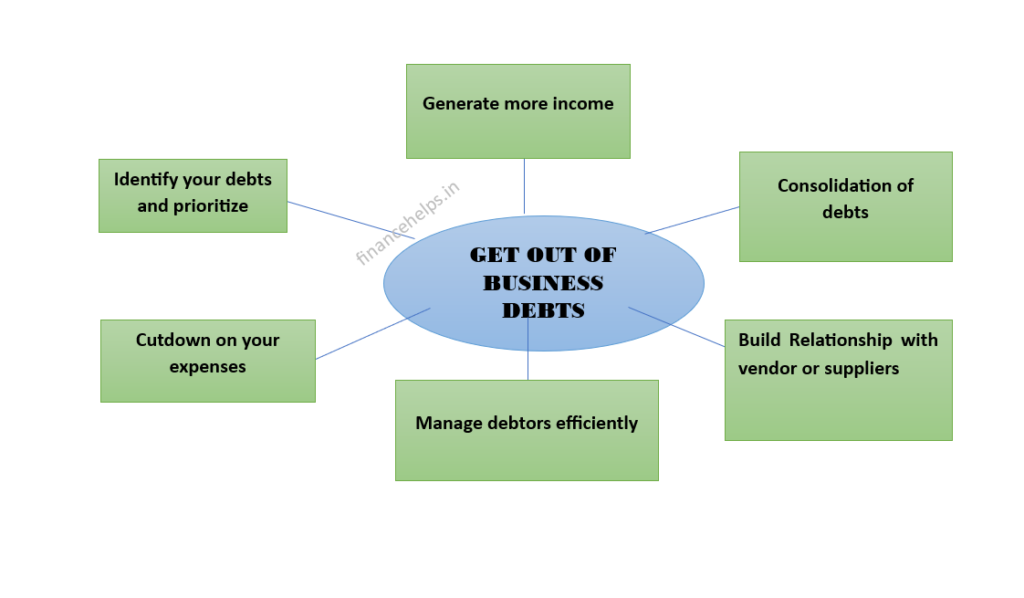

How can we reduce business debt is where the question lies. So, these are the points which we need to follow to reduce business debt.

6 Tips for Pay off Business Debt Quickly

- Identify your debts and prioritize

- Consolidation of debts

- Cutdown on your expenses

- Build relationship with vendor or suppliers

- Generate more income

- Manage debtors efficiently

Now let’s understand the above-mentioned points in detail.

Identify your debts and prioritize

To understand the company’s financial status, it’s important for an individual to go through the company balance sheet to check on the outstanding debt. Now, what is important is to identify and differentiate between a good debt and a bad debt. How do one know what a good debt and a bad debt is, the answer to this is if the debt is going to provide profit to the company on a long-term basis it will be considered as a good debt.

For example:-If the company has liability related to office space it could be considered as a good debt due to the potential of increase in the value of the space .Thus any debt that is backed by collateral should be paid of first as failing the same may result in loss of asset .Also any taxes or govt related payments should be prioritized to avoid additional penalties .Once the good debts are paid off the company can focus on clearing of other creditors .Doing this will help in reducing the overall debt burden of the company.

Consolidation of debts

By consolidation of debts, we mean to clear off several debts by using a single debt. To simplify it lets understand it this way. Say for example X must pay off to 50 different debts of certain amounts. Now he also will have to pay interest at different rates and different time which not only would be difficult to track but will also may result in missing out any. Thus, it’s always better that X takes up a loan of a bigger amount and try to clear of several debts which will help in reducing the number of debts and also might help in getting loan at a lower interest rate. This will also help in saving money over time.

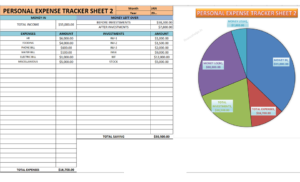

Cutdown on your expenses

Managing the monthly expenses which is one of the most important factors. Because unless you know what the amount is you will need for your business monthly expense and how much you will be able to save it will be difficult for you to fund for your debt repayment. Thus, one needs to figure out the amount they would be spending for incurring the expenses and where can there be cut down on expense. The best way to keep track of expense is to segregate the expense into recurring (expense which the business will have to incur every month) Operating (Expense which the business has to incur in the process of the functioning which comes up once or twice in a year) With this one would be able to understand the amount required every month for incurring the expense and set aside enough for other operating expenses.

Build relationship with vendor or suppliers

It’s important for a business to form a good relation with the vendors and suppliers because it’s the suppliers who will help the business keep on going by providing credit to the business. Any supplier will only provide credit to the business if both are on good terms. Also, the business should discuss with the supplier on payment terms and also credit limit which will help the business to plan well the payment. If a business enters into any credit agreements should be done with a clear understanding of risk and reward, if need be one should not hesitate in taking up professional help as is required to assure mutually beneficial outcomes to both parties.

Generate more income / funds

To pay off the debts obviously you will need to have enough funds. And if you don’t have enough funds with you then generating more income for the business is something which will help in clearing off your debts. One easy way to generate more income is increase your margin by raising the rates. This can be done by raising the prevailing rates and communicating the same to the customers also if they desire must be provided with the option to buy the product or service before the rise in price. This could help in enhancing one time revenue. Try to diversify your income buy adding products or by investing your existing money in FD or other mutual funds to earn money out of money. Clearing out old stocks at discounted rates can also help in generating revenue.

Manage debtors efficiently

Maintaining payment terms with your clients is important to manage proper funding for the business. One should try to maintain shorter time – period for payment to max of 60 days and 90 days in case of consistent clients. Also, business can provide discounts etc to the ones who agrees to pay larger part of due at a go. Suppose A buyer is ready to pay 70 percent of the amount on the day of purchase if he would be offered with additional 5 percent discount on the amount which can influence other buyers to pay early too.

These are 6 tips for pay off business debt quickly. These are the points which a business can implement to reduce off the debts. Debts are not always a burden for the company its just that one needs to efficiently manage it which would prove as a benefit for the organization in the long term.

Do get back to us with your comments and questions we are more than happy to help. Keep visiting financehelps.in for more such contents.

More on financehelps.in

Hi, I’m SG. Pradhan, the author & owner of the website “financehelps.in”. My expertise is in Financial Management & Accounting, Quality Management, Operation Management, Business Excellence, and Process Excellence. I am mech. engg. & certified internal and lead auditor.