Debt Management Plan Template | How to Eliminate Debt Fast?

Hello readers! Today’s topic is going to help you in planning and managing your debts. At some point in time, we all prefer taking up loans for personal use /home/education depending upon our requirements, also there are a lot of entrepreneurs arising be it on a small scale or large scale, to set up a business funding is one of the key factors which most of the times is in form of Debt which sometimes become a hassle for the owner of the business as he/she gets into a juggling position between the business and several other tasks. Amongst these tasks comes debt. So to minimize your worries and save your time we at financehelps.in have come up with a Debt Management Plan Template which will help you to manage your debts (like, home loan, car loan, etc.) in a simplified form. Today we will discuss personal debt management.

Download sample debt management plan template/excel format.

Download the monthly debt monitoring excel sheet.

What is Debt Management Plan?

Debt Management is the process of planning and controlling of your debts. Generally, a credit counseling agency is hired to create a plan for managing debt, but we at financehelps.in are here for you to help in creating one for yourself by using our debt management plan template excel format which is both simple and easy to use.

Using the excel you can plan to pay off debts as per some principle and general rules, specified by us for better managing your debt but you can customize the rules as per your convenience. The rules are given in the excel template as our thought. The best part of this excel is that you will get a clear picture of your funds and also get into a regular habit of repayment which will not only help in lowering your debt but also help you pay off the debt in a particular prefixed span without fail.

Let’s understand it better with the help of the excel we have created.

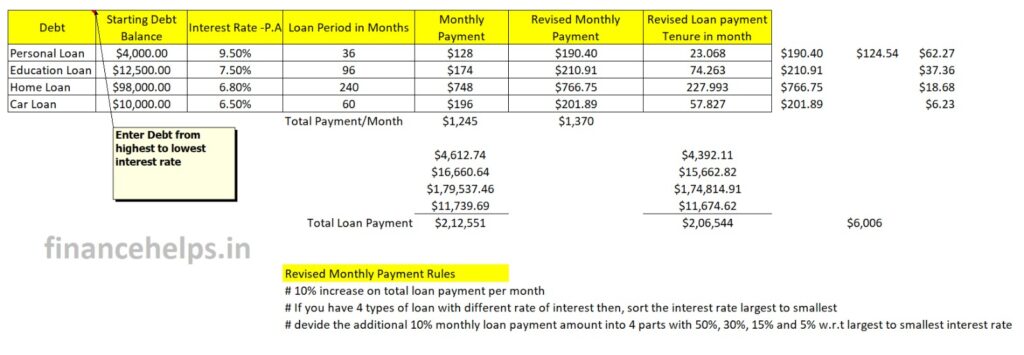

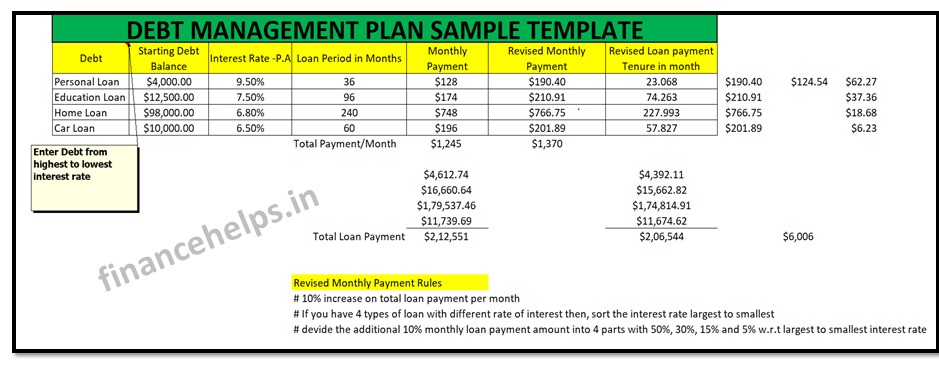

Say X has four kinds of Loan-Personal loans, Educational loans, Home loans, and Car loans.

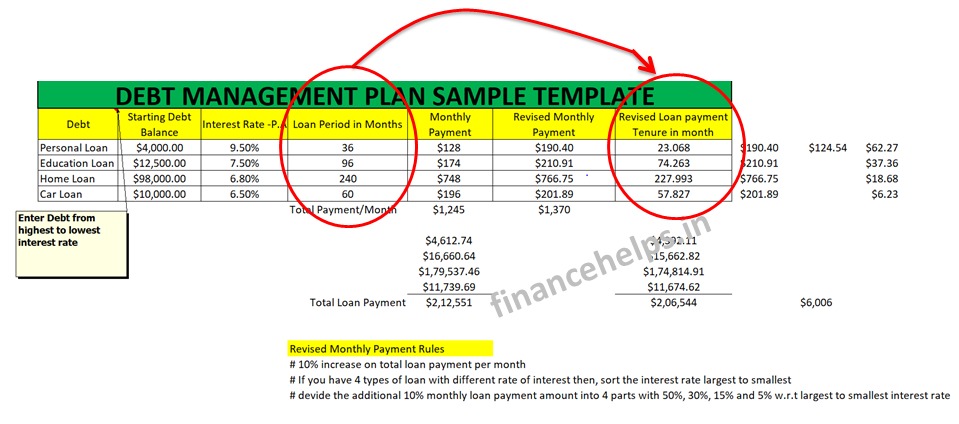

He took a personal loan of $4,000 @9.5% for a period of 3 years. Education Loan of $12,500 @7.5% for a period of 8 years. Home Loan of $98,000 @ 6.8% for a period of 20 years and Car Loan of $10,000 @6.5% for a period of 5 years. (Table view attached)

| Debt | Amount | Interest rate-P.A. | Time period (in years) |

| Personal Loan | $4,000 | 9.5% | 3 |

| Education Loan | $12,500 | 7.5% | 8 |

| Home Loan | $98,000 | 6.8% | 12 |

| Car Loan | $10,000 | 6.5% | 5 |

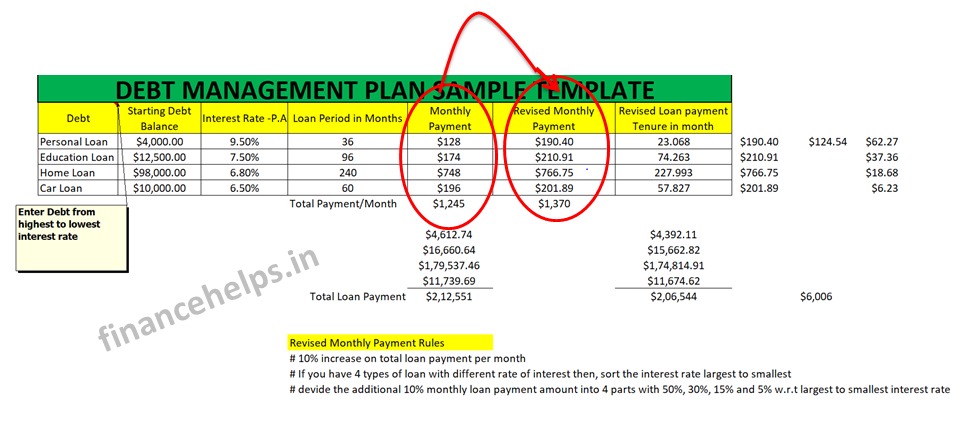

Now if X plans to pay the loan on a monthly basis, we find that he has to pay the following amounts per month.

For Personal Loan -$128 /month

For Education Loan-$174 /month

For Home Loan-$748 / month

For Car Loan -$196 /month

Considering all the total per month comes to $1,245. Here we see that X actually took a loan of $124,500 but on the calculation of the final payment the loan repayment comes to around $2,12,551 which comes to around 70% approx as interest payment.

| Debt | Amount | Interest rate-P.A. | Time period (in years) | Monthly Payment |

| Personal Loan | $4,000 | 9.5% | 3 | $128 |

| Education Loan | $12,500 | 7.5% | 8 | $174 |

| Home Loan | $98,000 | 6.8% | 12 | $748 |

| Car Loan | $10,000 | 6.5% | 5 | $196 |

| Total | $124,500 | $1,245 |

However, if we increase the per month loan payment by 10 percent, we find that the total per month payment will increase to $1,370/ month and total loan repayment at the end of the period amounts to $2,06,544

| Debt | Amount | Interest rate-P.A. | Time period (in years) | Monthly Payment | Revised Monthly payment |

| Personal Loan | $4,000 | 9.5% | 3 | $128 | $190 |

| Education Loan | $12,500 | 7.5% | 8 | $174 | $211 |

| Home Loan | $98,000 | 6.8% | 12 | $748 | $767 |

| Car Loan | $10,000 | 6.5% | 5 | $196 | $202 |

| Total | $124,500 | $1,245 | $1,370 |

Comparing both the cases we find that we are saving around $ 6,006 on total interest payment. Thus, for the above table, we understood that if we increase the amount of debt repayment per month then it will lead to saving in the amount of interest.

Download the debt management plan sample template (excel format) and use it to create your own debt management plan without any hassle.

As we believe that below are some tips or strategies that you may be followed to pay off debt faster

- Deep understanding of Terms and Interest rates

While taking a loan some people generally miss out on the vital points in the contract. Thus, it’s highly important to go through the term and conditions very deeply and not miss out on any point. Also, check on the interest rates properly.

- Pay more than the minimum period.

It is better to pay more amount as monthly repayment than look for the period of payment. You can plan your own strategy or you can follow our above 10% increase plan to better manage your monthly debt.

For Example;

- Pay off your most expensive or highest rate of interest loan first.

While planning the debt payment one should try to prioritize the debt in the sequence of high to low amount and then high to low-interest rate. Using this strategy you will be able to pay off the debt which has higher interest rate first because for the longer time you keep it in your list the more is the amount of interest you will have to pay .

- Shorter the length of your loan.

One should try to take loan for minimum period. As the shorter you keep the time of your loan the lesser amount you will pay on interest. You are supposed to try to increase your monthly amount payment as per your own plan or you can follow our above strategy to shorter the length of your loan.

For Example;

- Track the monthly expenses for better managing of funds.

For managing debt properly, one needs to manage the monthly expenses which is one of the most important factors. Because unless you know what is the amount you will need for your monthly expense and how much you will be able to save it will be difficult for you to fund for your debt repayment. Thus, one needs to figure out the amount they would be spending for incurring the expenses and where can there be cut down on expense. With this you would be able to understand the amount of your requirement.

- Set up a monthly budget.

The best way to track the monthly expense would be to prepare a budget keeping in mind the monthly income and accordingly prioritizing the expenses as per need. Budgeting will give clear picture of the amount which you will be left with to pay off the debt.

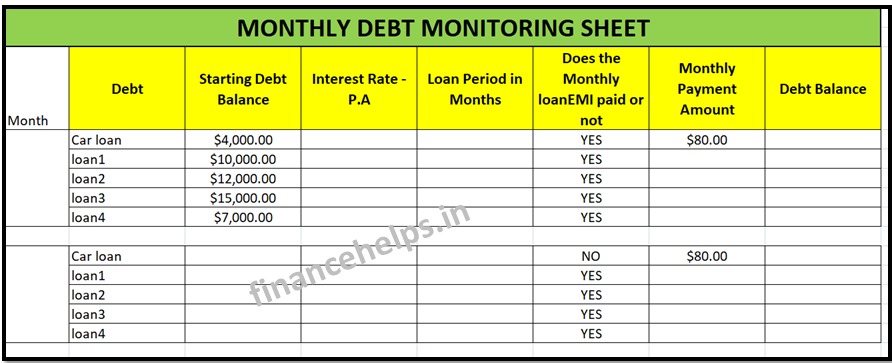

- Keep track the monthly debt payment.

While you have started with the debt payment you need to track the amount you are paying as debt and look for possible ways to increase in the amount of debt repayment to reduce the interest amount.

For Example; sample monthly debt monitoring sheet.

Download-Monthly debt monitoring excel sheet

- Work part time or generate passive income.

As we believe that in many scenarios it’s not easy to sustain only on monthly active income thus it has become important to have a passive income (which means generating income from additional source. For example, now a days there are freelancing, content writing, social media management, blogging, etc. which one can choose to generate additional revenue) this will generate additional revenue apart from the fixed amount. Which as a result will lessen the burden of debt repayment.

Following these strategies you can plan your debt easily and smoothly.

Do comment if you have any queries. We would be more than happy to help you out on the same. Keep visiting financehelps.in

Hi, I’m SG. Pradhan, the author & owner of the website “financehelps.in”. My expertise is in Financial Management & Accounting, Quality Management, Operation Management, Business Excellence, and Process Excellence. I am mech. engg. & certified internal and lead auditor.